extended child tax credit payments 2022

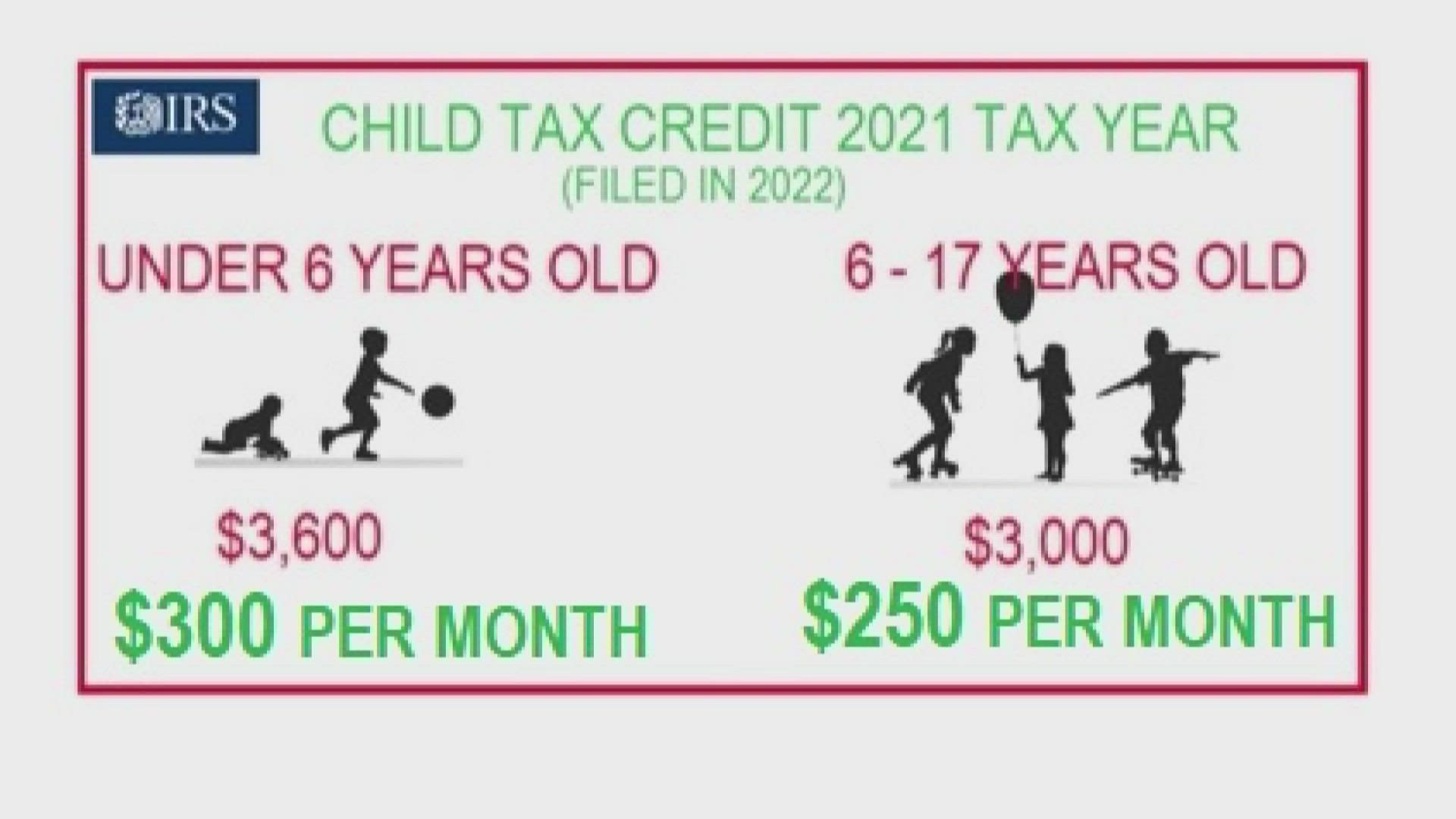

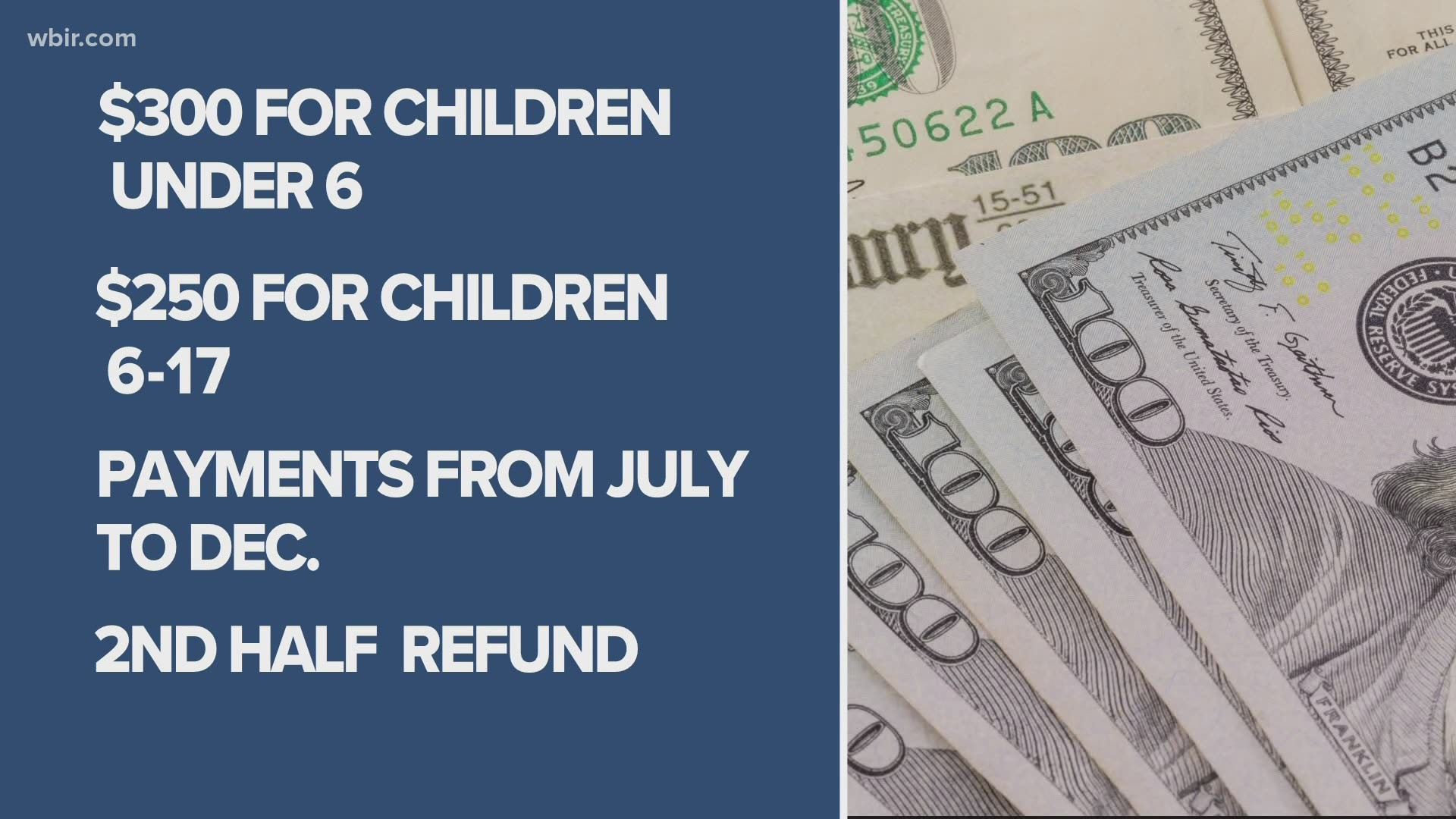

Families with children 5 and younger are eligible for credits of as much as 3600 per child with up to 300 received monthly in advance. If you have a newborn child in December or adopt a child you can claim up to 3600 for that child when you file your taxes in 2022.

Stimulus Check Update Child Tax Credit Bill Faces Uphill Battle

As part of the American Rescue Act signed into law by President Joe Biden in.

. Enhanced child tax credit payments which give checks to families worth up to 1800 per child are set to end in 2021 unless Congress acts. Eligible families are those who meet the requirements. According to the Tax Policy Center the price of reverting to the old child tax credit for 2022 would be about 1255 billion whereas the more generous benefit of 2021 which.

Filed a 2019 or 2020 tax return and claimed the. Furthermore the child tax credits payments in 2021 were worth up to 3600 per kid with eligible families receiving up to 300 per child each month. Moreover in the second half of 2021 it became possible to.

31 2022 in his Build Back Better plan. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. However despite calls for the expanded Child Tax Credit payments to be continued into 2022 progression has not gone as many in the Democrat party would have.

We will have Child Tax Credit in 2022 to help working families with income covered by the program. The final enhanced child tax credit payment is arriving with tax refunds this year. They can do this on their tax.

The credit will then revert back to its original amount of 2000 to be claimed in 2023. The current enhanced child. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. Ad Parents E-File to Get the Credits Deductions You Deserve. See what makes us different.

That includes the late payment of. Family Security Act and possible 350 monthly payments. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

We dont make judgments or prescribe specific policies. After they ended in 2021 families are now able to claim the second half of their credit. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Thus 3600 was offered for a child under the age of six and 3000 for children between the ages of six and 17. Those with children ages 6 to 17 are. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of.

To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. But others are still. Leading the charge is President Joe Biden himself who included a proposal to extend the enhanced child tax credit through Dec.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What Day Does The Child Tax Credit Come Out King5 Com

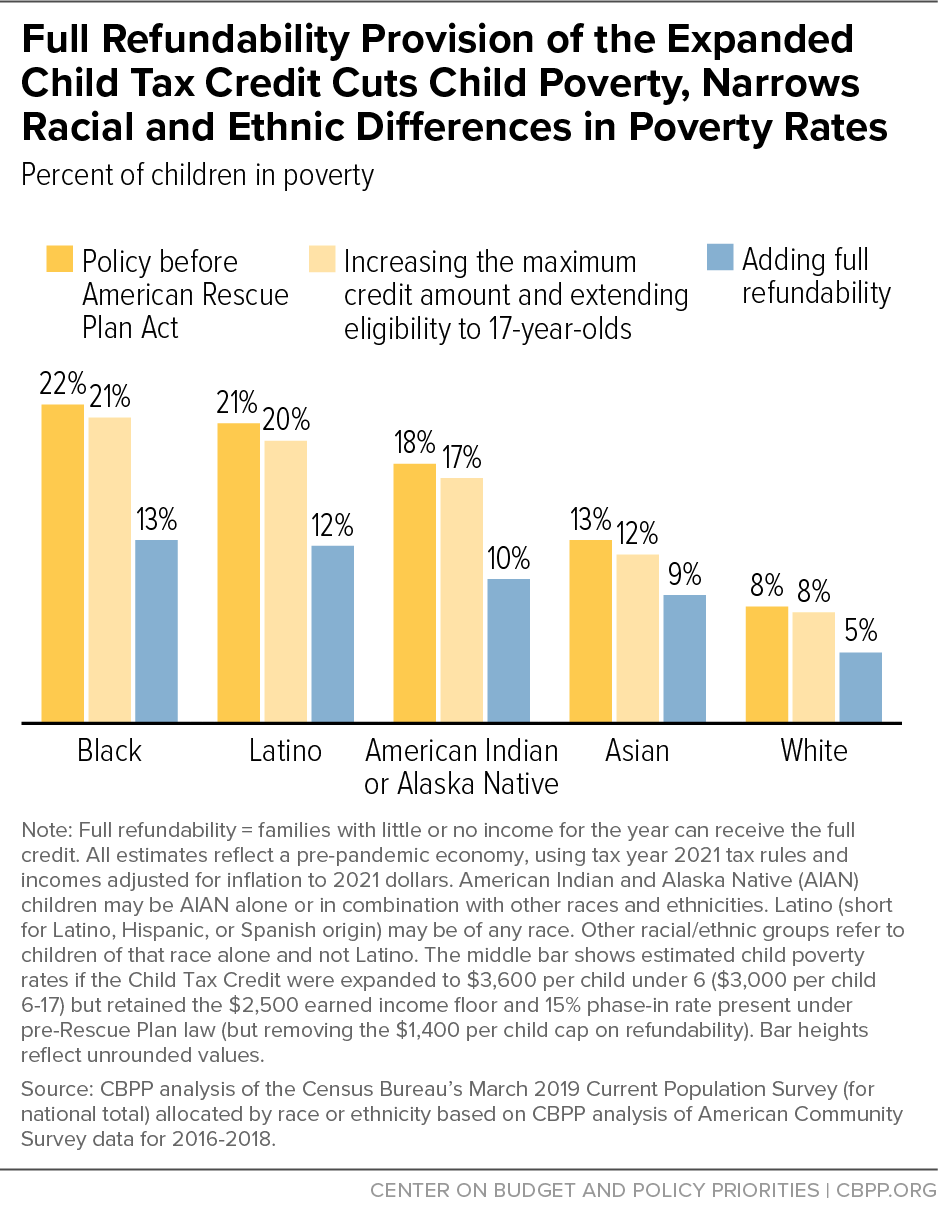

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

New Stimulus Payments Arrive This Week Some Families Will Get 1 800 Here S Why Wbff

Monthly Child Tax Credit Payments Have Ended And Their Future Is Unclear

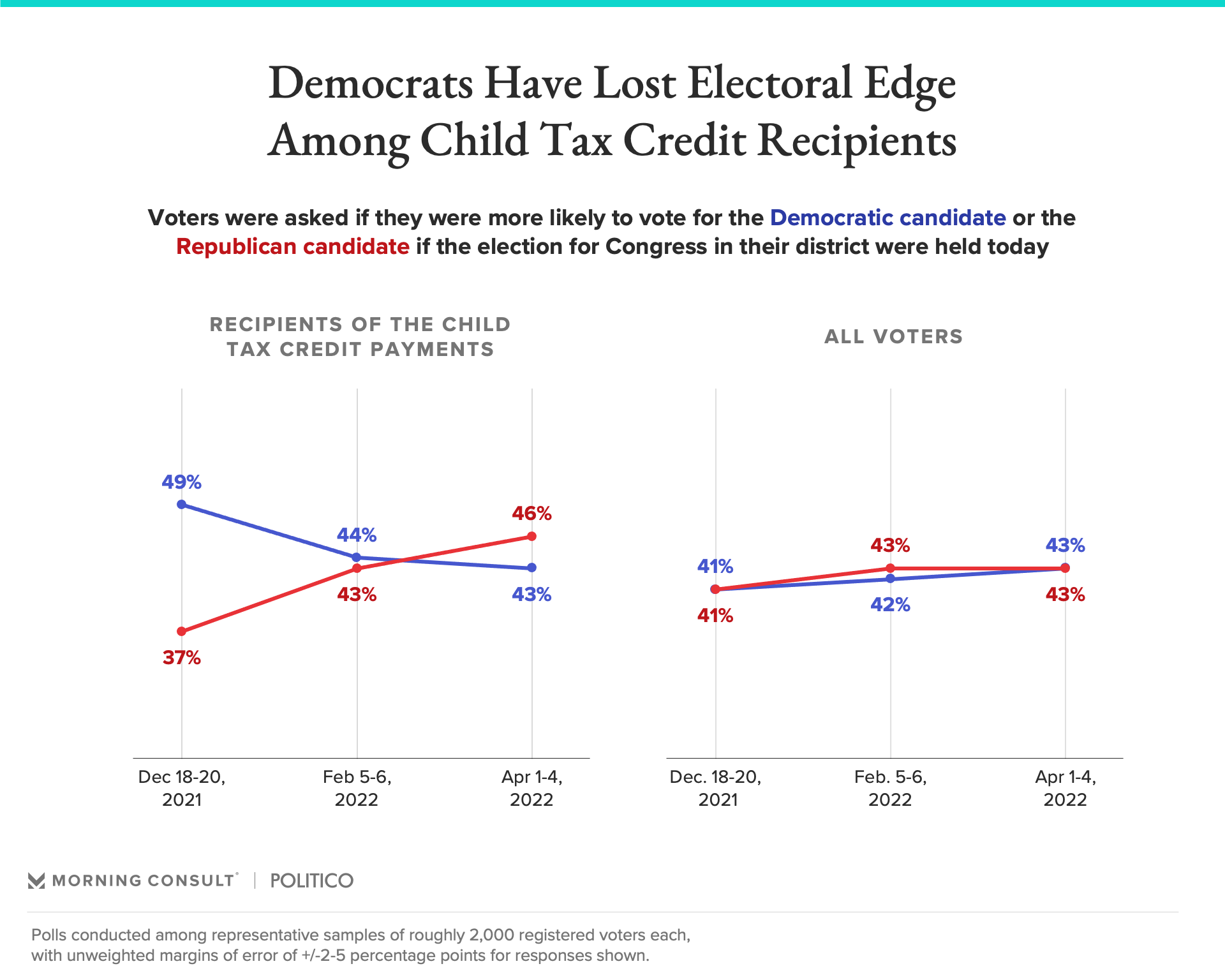

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

The Future Of The Child Tax Credit Tax Pro Center Intuit

Child Tax Credit 2022 Monthly Payment Still Uncertain 11alive Com

The 8 000 Child Tax Credit That Many Parents May Not Know About Cbs News

Will Child Tax Credit Payments Be Extended In 2022 Money

The American Families Plan Too Many Tax Credits For Children

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

What Is The Child Tax Credit Tax Policy Center

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Study Claims Parents Will Quit If Child Tax Credit Payments Are Extended Does Stimulus Hurt Labor Fingerlakes1 Com

Republicans Favored To Win Senate Among Child Tax Credit Recipients

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Child Tax Credit You Can Opt Out Of Monthly Payment Soon Abc10 Com